GFS rule stands for Grand Father – Father – Son Rule. Whenever I listen about GFS rule, I remembered a life changing quote. Once my mentor told me ” If you ignore GFS two times, it could be ok. But if you ignore GFS third time, it is not a fault, it’s a crime.”

Are you facing loss in stock market in recent times? or facing issues with your stocks? Most of the beginner investors of stock market or even experienced investors face loss in stock market. In Most of the cases is due to lack of knowledge about GFS rule in stock market and after losing stocks you might feeling little less motivated or want to quit the stock market. So, before making any decision let me tell you about my story. You might change your mind.

[articleAdToAppear]

The person who gains from their slip-ups will win the market certainly however the person who doesn’t comprehend the mix-ups won’t gain from his encounters. I started to invest in stock market and gradually I started to trade. The investment ended by making huge losses. I lost around 5 lakhs rupees. When I started to learn about the mistake, I realized that I have not searched anything about the company and made the decision based on my friend saying. I contributed beyond what I could bear to lose. The worst part that I had no strategy to use GFS rule in stock market for the investment and lose all the capital.

GFS Rule:

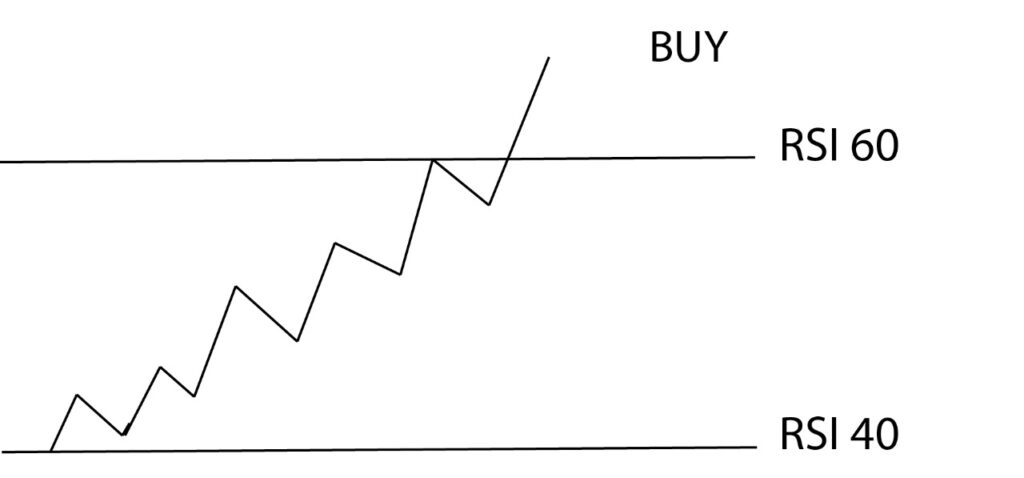

The GFS rule states that if the monthly chart RSI i.e. momentum indicator is above 60, if weekly chart RSI is above 60 , then the daily chart will definitely move upward and it will take support at 40. GFS is a standard rule in stock market.

If you are beginner at stock market, or even intermediate you can learn GFS rule to get more profit in stock market. GFS is totally based on RSI. let’s discuss how GFS rule is interconnected with RSI.

How GFS is interconnected with RSI:

Here we need to understand, what is RSI thumb rule. RSI thumb rule is that,-

If RSI is greater than 60, there is a bullish trend i.e. buying opportunity.

If RSI is between 40 to 60, there is a choppish trend i.e. we need to wait or see the market.

If RSI is lesser than 40, there is a bearish trend i.e. down trend.

So when monthly chart and weekly chart RSI is greater than 60, the daily chart RSI will move to uptrend. So there is huge buying opportunity in this time.

When to buy stocks:

Let’s discuss when you should buy stocks?

Buying Time: When we will get a big green candle, we should buy stocks.

Buying Price: Above big candle high

Stop loss: Below low

Target: Previous big candle high

We already discuss future of banking sector in 2023 where we suggest 4 best banking stocks you should buy in 2023 based on GFS Rule. Just go and check out to get maximum profit from market.

Nakivo wrote a very beautiful content on GFS backup strategy, You can check out here.

Now it’s your time to implement GFS rule in market so that you earn double than you invest. Remember, knowledge is nothing without implementation. Whatever we learn, we should implement. Hope you will invest in the market by using this trick GFS rule. And don’t forget to share this article to everyone so that each one can invest money in stocks and gain more profit in 2023. All you should do is implementation. Stock market is practical field. How much you will implement your knowledge practically in this field, you will be highest gainer gradually.

Frequently Asked Questions:

Q ) What does GFS stand for in stock market?

GFS stands for Grandfather-father-son

Q ) What is GFS (grandfather father son retention policy)?

The GFS rule states that if the monthly chart RSI i.e. momentum indicator is above 60, if weekly chart RSI is above 60 , then the daily chart will definitely move upward and it will take support at 40. GFS is a standard rule in stock market.

Q ) What is the grandfather-father-son (GFS) backup strategy?

GFS rule stands for Grand Father – Father – Son Rule. The GFS rule states that if the monthly chart RSI i.e. momentum indicator is above 60, if weekly chart RSI is above 60 , then the daily chart will definitely move upward and it will take support at 40. GFS is a standard rule in stock market. GFS is a standard rule in stock market.

[multiplexAdToAppear]

Pingback: Best Banking Stocks You Should Buy In This Week - Stock Trade 360